In this article we're taking a bit of a different take. Rather than focusing on technical updates, we've decided to share a few of our thoughts on protecting business wealth in times of uncertainty.

Managing a company's assets and savings responsibly is as important as maintaining quality of services & products, or hiring top staff. Assets & savings are what allow a business to traverse through transition periods, explore new opportunities, and smoothly hire as demand grows. In times of stability, this seems pretty straightforward: avoid variable rate debt or avoid debt all together if you can, build up bank account savings, get solid reporting on financials, and focus on the core business offerings. How does this change in times of uncertainty?

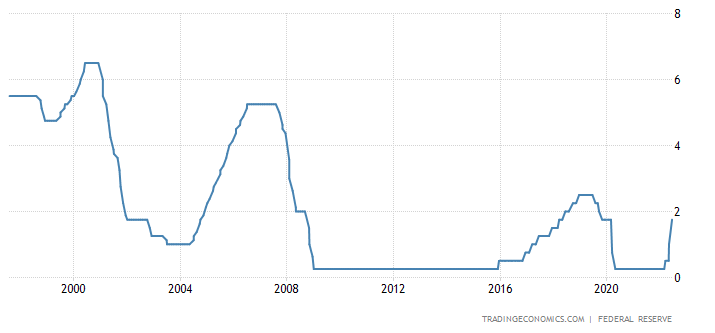

First of all it's important to be able to acknowledge when we are living through a time of uncertainty. The government's consumer price index has seen sharp rises over the past year: CPI Home : U.S. Bureau of Labor Statistics (bls.gov). Inflation has reached levels not seen since the 70s. Moreover, data analysis reveals that the government metrics have adjusted since the 70s, especially with regard to shelter. If left unadjusted, CPI rates would be equal to or greater than those of the 70s - which is a scary thought. In response to this interest rates have been raised. We can look at a history of Federal Reserve rate hikes over time and see that they are not a smooth line, but a series of steep rises punctuated by complete drops - usually coinciding with some kind of financial or market crisis of varying magnitude. For example, we see that rates rose steadily in 2004, peaked in 2007 and then crashed. The same happened before the .com bubble earlier.

Federal Reserve Interest Rates - financial crises are always preceded by rising rates

Federal Reserve Interest Rates - financial crises are always preceded by rising rates

So what do I think will happen in 2022? I'm not here to tell you that. I am not a financial advisor. Nor am I here to judge policy decisions or politics. I am however, a business owner and so managing risk and protecting assets falls in line with my duties. With this data I simply wish to point out that we are living in a time of financial uncertainty in the US and throughout the world.

Counterparty Risk

To be able to protect assets, you must first understand what they are. Most monetary assets in our system are forms of debt, and therefore subject to counterparty risk. Counterparty risk could also be described as "default" risk - it is the chance that companies or individuals will be unable to uphold their end of a financial bargain. In particular, it is the risk that an entity will not be able to make a required payment on debt. This is not just a reality to understand for banks and financial institutions, but all entities that manage wealth. Why you might ask, is this a concern for a business? Because in today's monetary system, all money is debt.

Said another way, all common forms of fiat money today have 2 sides: they are an asset for 1 entity and a liability for another entity. This includes bank accounts as well as cash. Paper cash dollars are an asset of the holder, and a liability (or debt) of the Federal Reserve Banks. This is why since 1971 a dollar bill has had printed on it "Federal Reserve Note". It is a promissory note of the Federal Reserve. Banks convert a small portion of their "reserves", a kind of money exclusive to banks, into cash to have available for customers. Similarly, bank deposits - in the form of checking or savings account money - is an asset of the account holder, and a liability of the bank. Despite seeing the balance with a dollar sign next to it when you login to your bank account, there is not necessarily cash or reserves in the bank to fulfill liquidating your account in full at all times. It is a debt owed by the bank to the account holder and thus exists primarily as a simple ledger entry. In normal, stable conditions this is not a problem. In a time of instability, if everyone were to withdraw at once, this creates the phenomenon called a "bank run." The popular movie "It's a Wonderful Life" exemplifies well how such a phenomenon can unfold.

A "bank run" in the movie It's a Wonderful Life

A "bank run" in the movie It's a Wonderful Life

In 1933 the Federal Deposit Insurance Corporation was created to protect against just such events. The FDIC acts like insurance for the bank. In the case of insolvency for a bank, they will re-imburse depositors of their lost money. The bank goes out of business, is bought by a competitor, or is nationalized by the government - but the people get their money. What few people know, however, is that the FDIC only protects up to $250,000 per account. So in other words, if your business has $1 million in assets, all stored in savings at a local bank, and that bank goes bust - you end up with just $250k. We are not here to be a doomsday prophet, but to help fellow business owners manage risk. You cannot manage risk if you don't know what those risks are. Perhaps, given the unlikelihood of bankruptcy, in the scenario above $750k lost is an acceptable risk - because the chance is so minute. Only you can answer that question.

If your business has a lot of wealth to protect, here are some options to consider:

- An account at a different bank spreads your risk, and doubles your FDIC coverage

- Joint accounts and other financial account types can increase coverage

- Short dated treasuries of 1yr or less can be purchased via a brokerage account. While these do have counterparty risk, as they are liabilities of the US govt, the govt is generally able to print more money to meet its obligations. They must be held to maturity to guarantee dollar value and avoid the fluctuations of the bond market.

- Wealth can also be stored in tangible assets, which tend to withstand inflation better than fiat

Tangible Assets

While fiat money is debt, and therefore subject to both loss of value through the bankruptcy and the inflation of monetary units, tangible assets have intrinsic value and can be stored with little to no counterparty risk. There are many tangible stores of value. In a normal, functioning economy, real estate is one of the biggest means to preserve & grow wealth. Unfortunately, real estate is tied at the hip to the financial economy today and so comes with some risks. Ever since the 2008 Great Financial Crisis (GFC), the Federal Reserve has been buying billions upon billions of mortgage backed securities, to buffer up & provide liquidity to the home mortgage market. While this indeed saved the economy from further downturn in 2008, it arguably has again inflated the value of homes & real estate across the nation to well above fair market value. In the first half of 2022, the Federal Reserve laid out a plan to stop all purchases of mortgage backed securities. Combined with a slowing economy, this decrease in demand could have serious ramifications for home values.

That being said, what is needed is an asset that is not directly tied to risky financial assets, has little to no counterparty risk, and which serves the purpose of being a kind of insurance against financial calamity. Cash is great to have on hand for this purpose, but loses value when stored for years. The asset that best fulfills this role in our humble opinion is gold, and it's smaller cousin, silver. Gold has been considered money for 5000 thousand years. But before you call us ancient and out of touch, consider this:

- Central banks across the globe accumulate gold every year

- Large commercial banks, such as JP Morgan, own hordes of gold and silver in their vaults

- January 2022, BASEL III regulations, which were designed to protect against future crises like the 2008 GFC, made gold a tier 1 asset for banks - on par with reserves or cash in the vaults.

- Many professional traders & investment managers allocate a small portion of their capital to gold as a safe haven

- In 2020 some state run pension funds began allocating ~5% of their assets to gold, more have followed suit since

- In the past 3 years, multiple states have taken steps to start again treating gold and silver as legal tender - making it exempt from state sales fees & capital gains taxes.

- Constitutionally, gold and silver are still recognized as money

We are not saying one should put all their savings into gold and silver. Furthermore, this article is not in any way investment advice. This is a mere thought experiment to consider risks to business assets, and options for mitigating those risks. Gold & silver is not an investment. Gold & silver is money, and a means to protect wealth. It is "cold, hard, cash" a name that came from the feel of precious metals when you hold them. It is a valuable commodity that happens to be able to be packed into a small coin or bar and stored away for dozens or hundreds of years.

All that being said, it is my considered opinion that gold & silver are one of many useful tools in the chest of a business owner to store and protect accumulated wealth for future use. They are tools that are mostly overlooked in today's economy, and this is why I wanted to draw some attention to them to provoke some thought.

How can one go about purchasing precious metals?

- For physical metals in your own vault, you can utilize a bullion dealer such as sdbullion.com, jmbullion.com or apmex.com. One should almost always maximize the quantity of oz's and avoid paying extra premium for decorative quality. These have the least counterparty risk, but are harder to liquidate back into fiat dollars

- Or purchase direct from a mint such as Scottsdale Mint

- For more liquidity when you need to sell, or for employee retirement accounts, one can purchase metals through a brokerage account just like a "stock", using physically backed assets such as the tickers PSLV and PHYS by Sprott

- Kinesis also allows one to convert between metals and cash as well as crypto, and has vaults in the US

This is not a plug for metal companies, nor is it investment advice. We merely wish to help fellow business owners think outside the box regarding potential risks, and tools available to protect wealth - all in order to allow our families and our employees to thrive and continue to provide value in our respective industries.

Thank you for your time!